Why DAO's Can Save The World

Introduction

I recently read Ray Dalio’s ‘Principles for Dealing with the Changing World Order: Why Nations Succeed and Fail’. In this book, Ray details how we are heading towards the end of a long term debt cycle that began after WW2 and will eventually lead to a reshuffling of the world monetary order.

This left me to wonder what would happen if this restructuring took place in contemporary times.

The invention and popularisation of blockchain technology, has been the free markets counter-play to fiat currency and centralised monetary control. It has given the world access to cryptographically secured, policy-neutral, permissionless, censorship-resistant, immutable, programmable currency.

The combination of these properties provides an axiom of truth that could have profound benefits for society.

In this essay, I explore the possibility that in the event of a loss of confidence and reshuffle of western governance, DAO’s (Decentralised Autonomous Organisations) can provide a robust solution that will lead the way forward.

The End is Nigh?

For those who are unaware the US dollar is currently the worlds reserve currency. This is the monetary world order that was established after World War 2 with the Bretton Woods Agreement. This allows the US significant leverage in its ability to monetise its debts by printing money.

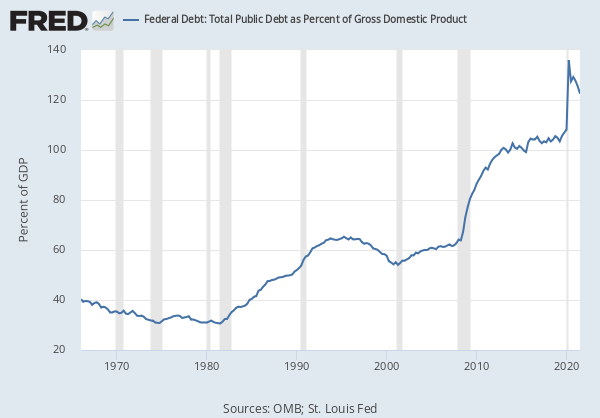

FEDERAL DEBT: Total Public Debt as a Percentage of Gross Domestic Product:

As you can see above, Federal Public Debt as a Percentage of Gross Domestic Product is rising at an increasing rate.

The Federal Reserve is currently having to inflate its way out of its national debt. Due to high levels of debt within the system, interest rate hikes to rein in inflation will likely cause huge deleveraging in the economy. Austerity measures to balance the books during a global pandemic are also politically untenable. It is quite clear that the market is dependant on the continuation of expansionary monetary policy.

FOMC meetings are becoming increasingly juxtaposed in their outcomes. Jerome Powell taking a dovish or hawkish tone on rate hikes or tapering single-handedly moves the market. Many believe that the Federal Reserve and central banks around the world have entered into a Faustian Bargain1 that will lead to the current monetary order collapsing.

Ray Dalio argues in his book that this could be the beginning of the end of the current world order of US dominance. With China now betting that the West is in irreversible decline2. This shakeup will end with the US dollar ultimately losing its status as the worlds reserve currency and potentially the end of Pax Americana.

This kind of shift has happened before, notably with the fall of the British Empire and its reserve currency the Pound, and the end of the Dutch empire with its reserve currency the Guilder. Such times have been extremely turbulent. New orders are normally established with conflict.

In summary, it looks like inevitable macroeconomic and geopolitical forces may be leading the west into some kind of monetary and political reshuffling.

Problems with the West’s Institutions

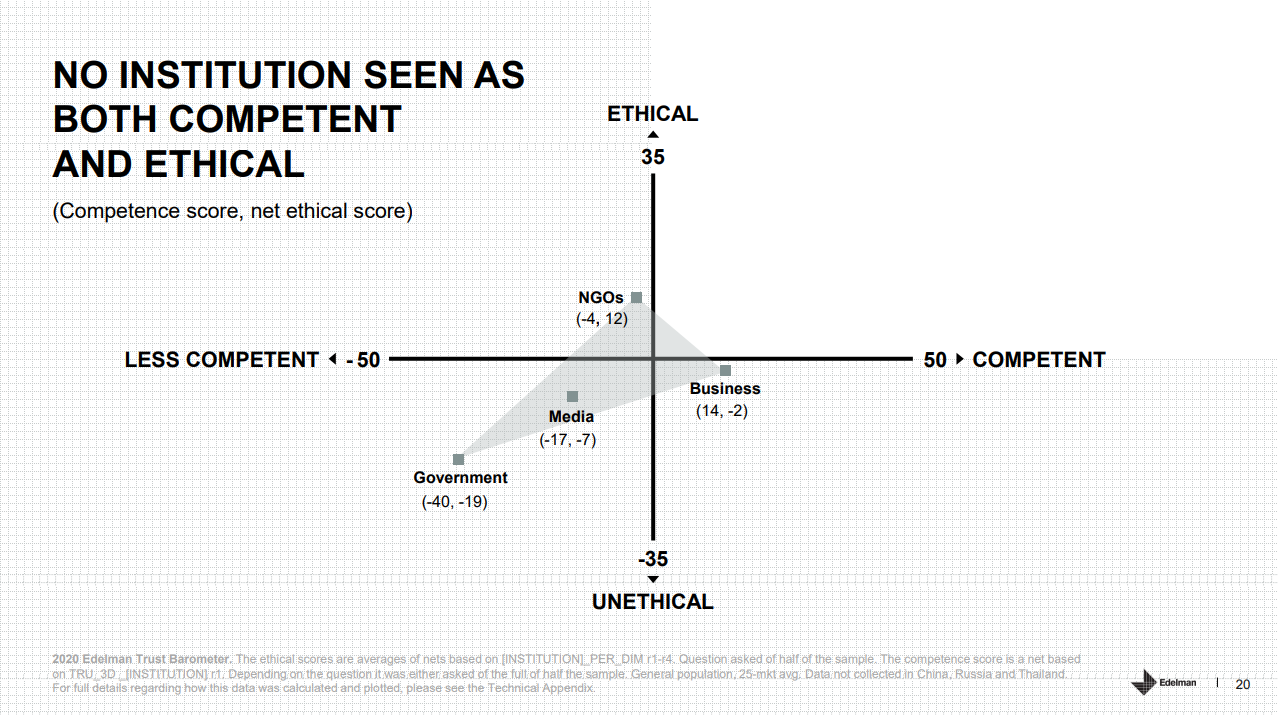

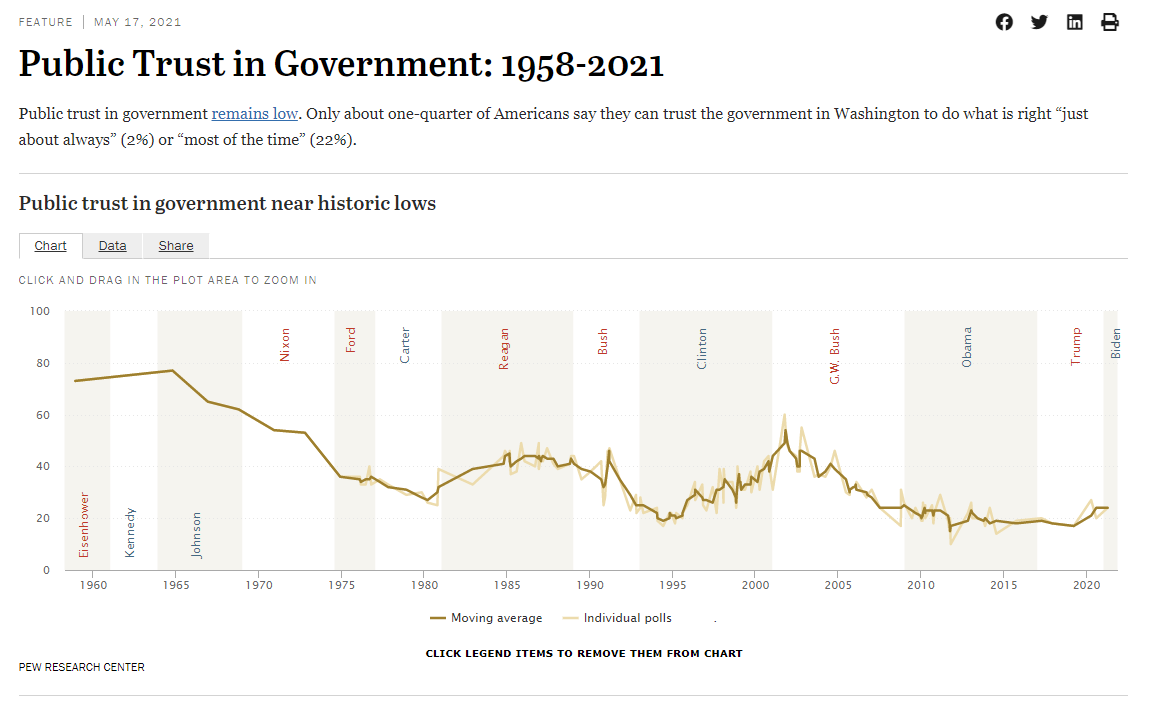

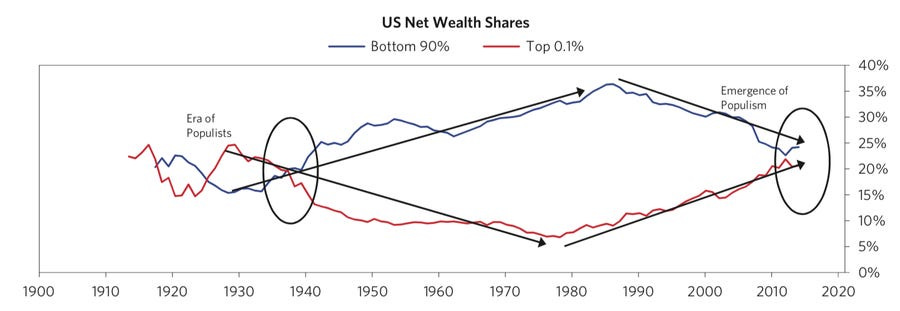

The state of the West’s internal (dis)order appears to reflect that of its external order. A lack of transparency, short term preferenced policy-making, along with a widening wealth gap, has led to the decline of perceived trust and belief in the competency of policymakers and institutions.

The illustration below shows how there is a growing distrust and disbelief in the West’s institutions:

Interestingly, the creation of new money has a profound effect on the wealth inequality of a nation. This is due to the cantillation effect, described by economist Richard Cantillon and summarised very well in this article here.

A point that is very well made in The Bitcoin Standard by Saifedean Ammous, is that a society with unsound money will ultimately have corrupt institutions. This is because a monopoly of money creation leads to abuse and the centralisation of power, along with a lack of accountability, for reasons discussed previously.

In his book, Saifedean also describes how unsound money affects culture and internal order by reducing peoples time preferences. Short term time preferences and an unwillingness to delay gratification leads to a lack of investment into sectors that drive growth and productivity, such as education. The book is a great read and I would highly recommend it.

Unsound money also leads to great inefficiencies and misallocation of resources in an economy, this is a very bad thing for future prosperity (think the informational theory of money3 and how price coordinates an economy). How well were governments able to allocate capital during the Soviet Union and in other communist states?

Another current inefficiency within our institutions was put well by Elon Musk on the Lex Freidman podcast. If you are to think of rules created by the government as you would lines of code in a computer program, too much bloat of hogwash rules make the system overly complex and inefficient. Currently, there is no impetus to get rid of redundant rules. It is widely known that the more rules in a system, the easier it is to find loopholes and circumnavigate them. All of this makes the system inefficient and weak. Surely from time to time, we need to remove the dross?

Social Contract Theory

The relationship between a government and its people can be described through social contract theory. I thought this was an interesting point to add as it links in nicely to the idea of smart contracts.

Thomas Hobbs, who was one of the original thinkers on the topic lived through the English Civil War. A war was waged between the Royalists and the Parliamentarians to establish a new internal political order. The result of this was the regicide of King Charles I and the establishment of a commonwealth.

These experiences inspired Hobbs to publish ‘Leviathan’ in 1651. This is considered to be one of the first examples of social contract theory in which he explores the nature of the authority of the state over the individual. Hobbs is famous for saying that without a ‘social contract’ or in a "state of nature", human life would be "solitary, poor, nasty, brutish and short". What he means by this is without formal rules that work in the interest of all, people would have complete freedom of actions, and this ‘state of nature’, is complete chaos where there is maximum political entropy.

Therefore, we need a social contract to enforce property rights and protect our safety. An obvious example of when a social contract was codified is the US constitution. It is becoming more and more evident that the innovations such as smart contracts, within the blockchain space, have something serious to offer here.

The Age of the DAO

What if there was a way to automate many of the functions of centralised power, in an open-source way?

The use of DAO governance along with quadratic funding could help reshape the way we run society. It would allow the automation of key organisational responsibilities and provide a bottom-up approach to governance.

To think about organisations on contractual terms; “It is important to recognise that most organisations are simply legal fictions which serve as a nexus for a set of contracting relationships among individuals.”4 To improve organisations we need to improve the contracts they are based upon and streamline the arbitration of those contracts.

What is a DAO?

A DAO is essentially a collection of smart contracts that govern a community or organisations treasury. These smart contracts allow for clear and transparent governance that is open source and automated.

What are smart contracts?

Smart contracts were initially theorised by Nick Szabo as self-enforcing, trustless contracts that remove the need for third parties. Smart contracts are peer-to-peer in nature.

What is great about cryptocurrency is that it is programable. Meaning, smart contracts can be built on top of it. Smart contracts are digital contracts that execute automatically. The example Nick Szabo uses is a vending machine5, where a certain input, say 20p, will give you a certain output of 5p change and a chocolate bar.

Cryptocurrencies are native tokens of blockchains. Blockchains are highly secure, censorship-resistant, policy-neutral and permissionless. This provides an extremely effective platform to build smart contracts that are trustless and self-executing.

The implications of their adoption are fascinating. Entities can contract with each other without interference from the state. If geopolitics do take a dark turn, we will need this. If this interests you, read; ‘From Imperial China to Cyberspace: Contracting Without the State’ by David Friedman here.

Benefits of DAO’s Over Traditional Organisations

Decentralisation

DAO’s, once created, are instantly global. Due to their decentralised, bottom-up governance structure, there is no single point of failure. They are therefore far more robust from a financial infrastructure perspective and they do not rely on banks and benefit from blockchains finality of settlement.

The reason that decentralisation increases the robustness of a network is that there is no single point of failure. This reduction of fragility and centralisation mimics that of fungal networks, improving their reaction to catastrophes and disorder. The gospel on this topic is, Nassim Teleb’s; ‘Antifragile: Things That Gain from Disorder.’

Another benefit of decentralisation is that DAO’s are borderless. As blockchains operate globally and out of the reach of nation-states, an individual can participate anywhere in the world that has an internet connection. This massively diversifies the talent pool; remember that empires are built by getting capital into the hands of those that can utilise it best. DAO’s structures represent a more pure free-market model that will enable this.

Transparency

Smart contracts that comprise DAO structures are open-source. Therefore, they allow for participants to audit and verify contracts before they are interacted with. This is the source of truth I mentioned previously.

Fraud-less Voting Systems

DAO’s can easily integrate smart contract voting systems. Imagine the benefits a smart contract voting system could have in third world countries rife with corruption. These can be valuable tools in protecting democracy. As they are open-source, anyone anywhere can audit them.

Reduction of Bureaucracy and Rent-Seeking

Functions and roles of individuals within a DAO are delegated transparently. This leads to far less rent-seeking than in traditional organisations. Individuals are rewarded based on their contributions to the organisation. It’s harder for nepotism and cronyism to permeate an organisation based on digital reputations.

Due to the nature of DAO governance, there is also little scope for bureaucracy. Proposals are put forward by any member of an organisation and are directly voted upon by the governance token holders. This is somewhat akin to the Reddit upvote system.

Meritocracy

DAO’s can provide a purer meritocracy for organisations. If members of an organisation are hired based purely on digital reputations and are rewarded in an open-source system. The rewards of their efforts will more likely reflect the benefits they bring. If someone is disproportionately rewarded, this will be evidenced on the blockchain, this can be audited and queried with ease.

Treasury management

Within a DAO system, an organisations treasury can be directly controlled by its governors. Rules can be added to DAO’s via lines of code within their constituent smart contracts, these rules determine where funds are allocated. The balance, inflows and outflows of a treasury are easily auditable and funds can be quickly traced to their source, this will, in turn, improve transparency and reduce fraud.

Capital Allocation for Public Goods

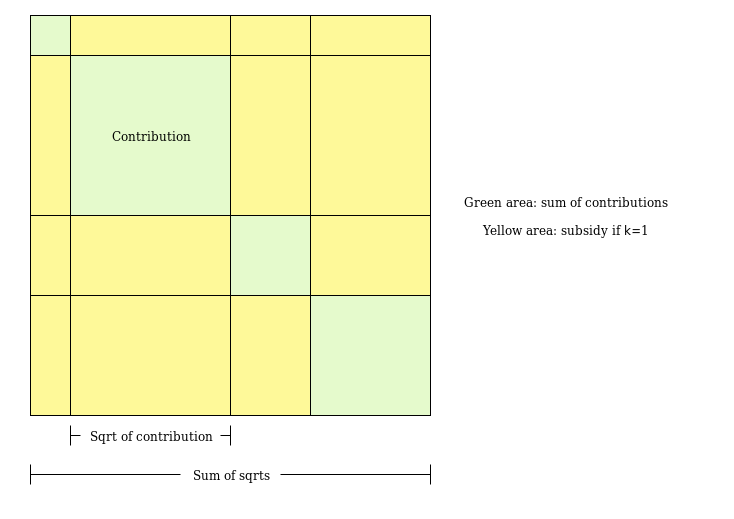

Quadratic funding is a useful tool that can effectively allocate treasury funds to public goods.

Quadratic Funding Graph:

Vitalik Buterin proposed a mathematical model of quadratic voting6 that can be used to effectively determine the value of a public good. Once a public good has had its value correctly established, a DAO treasury can then allocate resources to that good with improved efficiency. For further reading on the topic visit Vitalik’s; Quadratic Payments: A Primer.

Active use of quadratic funding in action already with Gitcoin grants. Established in 2017 to ‘build and sustain digital public goods’, Gitcoin has been highly popular with the open-source community. Over $50.1M has been allocated via its treasury to fund open source projects to date.

Draw Back Of DAO’s

Blockchains and DAO’s are not without their pitfalls, however, they can be, and are being, improved.

Famous email’s from Hal Finney to Satoshi Nakamoto in November 2008 discuss how blockchains do not seem to scale to the required size. Still, at this moment in time, the blockchain scaling debate is not solved. To deliver its properties to the world, it will need to scale some orders of magnitude.

There are however some very promising scaling solutions in the form of layer 2 chains, rollups, state chains, as well as the bundle of solutions included in Ethereum 2.07. The key to scaling properly is to preserve the properties that make blockchain great.

There are risks regarding the security of DAO’s code. Famously it was the first DAO named ‘The DAO’ that was hacked in 2016 and over $60m of Ethereum tokens were stolen. To restore the funds, this caused a controversial hard fork that would split Ethereum from Ethereum classic.

There are also regulatory concerns with DAOs. The great thing about traditional LLC’s that they limit the liability of participants. To avoid DAO members from being held liable for every action a DAO takes, founders are taking precautions that involve creating traditional companies that are registered in the country of main financial activity. Currently, DAO’s are a bit of a legal quagmire that involve creating offshore foundations and onshore LLC’s. Because of this, DAO’s are actually governed by their articles of association and not the DAO itself. A good article outlining the legal structures for DAO’s can be found here.

Conclusion

At the time of writing this, there is significant civil unrest all around the globe. Debts are rising at an alarming rate, inequality gaps are widening and our institutions appear to be failing to provide solutions to the hard problems that we are faced as a society.

It seems likely that our current trajectory will require a reshuffle. Should we not self-correct, we may be forced to employ some kind of DAO structure sooner than is currently anticipated.

Just as we need sound money to properly coordinate the economy, we also need sound governance structures.

Governance that runs on blockchain rails is vastly more transparent, fair and free. Therefore it is well suited to provide confidence in a system that is struggling with corruption and fraud. It makes sense to replace functions of government with trustless automated systems that are far more efficient and less prone to corruption.

DAO’s are not yet advanced enough to completely dethrone the government in a kind of crypto-anarchist sense. There is still much to be done in improving blockchain enabling tools, such as wallets and digital identity technologies. Not to mention scaling solutions for blockchains themselves.

The good news is that there seems to be a recognition at large that these technologies are going to change the world. There are significant financial inflows that are being utilised to build this infrastructure and there are streams of human talent that are entering the space recognising its potential in the long term.

If we see widespread adoption within 5 or 20 years, I am optimistic that DAO’s will be able to provide a universal infrastructure for global commerce. This would allow a more free and open society.

So, I believe that DAO’s can indeed save the world.

Thanks for reading.

https://www.guggenheimpartners.com/perspectives/global-cio-outlook/the-faustian-bargain

https://www.economist.com/china/2021/03/31/china-is-betting-that-the-west-is-in-irreversible-decline

https://medium.com/the-bitcoin-times/information-theory-of-money-36247aebdfe1#:~:text=%E2%80%9CMoney%20is%20the%20central%20information,about%20the%20conditions%20of%20markets.&text=Making%20money%20represents%20the%20efficient,an%20efficient%20use%20of%20capital.

Theory of the firm: Managerial behaviour, agency costs and ownership structure, 1976, p. 310

https://nakamotoinstitute.org/the-idea-of-smart-contracts/

Liberal Radicalism: A Flexible Design For Philanthropic Matching Funds: https://deliverypdf.ssrn.com/delivery.phpID=296064003086023019031125079007006023051084051044068022009103070027118027065116111025061001111055010001121125026026028016099113126046036051078022073126066070000123105004030032090000078068114100091115078069092122028006074113013081103080028097089093001122&EXT=pdf&INDEX=TRUE

https://ethereum.org/en/developers/docs/scaling/